Platinum price development – C.Hafner's report for Q4

Platinum rises in price on concerns of supply shortages

The biggest surprise on the precious metals market in the last three months was the sharp rise in the price of platinum. A market deficit of around 15% is predicted for 2023.

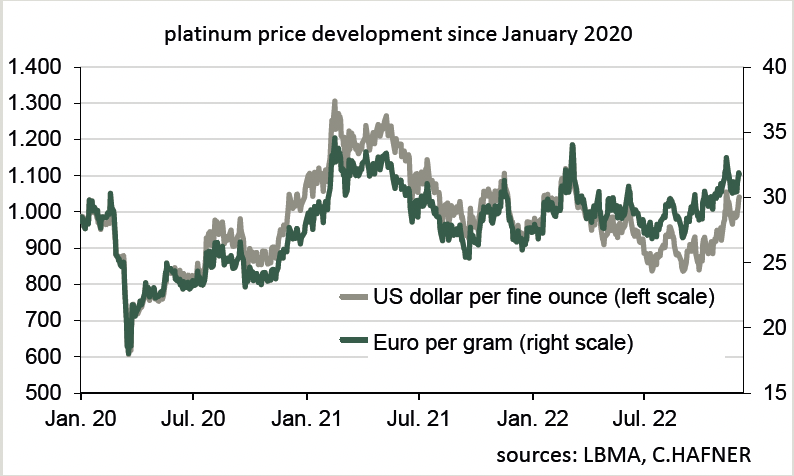

At the beginning and end of September, the platinum price was below the mark of US$850 per troy ounce (about €28 per gram). Currently, however, the price is around US$1,050 per troy ounce (just under €32 per gram). The price peak of March has not yet been reached, but platinum is at least nominally more expensive than at the end of 2021, when the price was just under US$970. Anyone who wants to look at the situation in detail should of course take inflation into account in the meantime, something that is usually forgotten on the stock market. Seen in this light, platinum has not really increased in price since the beginning of the year. But the most recent movement needs explanation, especially as the sister metal, palladium, became cheaper at the same time.

First, strikes and power cuts in South Africa, by far the most important producing country, led to a price spike. And at the end of November, the World Platinum Investment Council (WPIC) caused an increase in the price of the precious metal with its forecast of a market deficit. According to this forecast, higher demand in the coming year will lead to a supply gap of 1.1 million troy ounces, i.e., 34 tonnes or about 15% of the expected supply.

At second glance, it becomes apparent that this prognosis has shaky foundations. The deficit is largely due to an expected increase in platinum purchases for investment purposes, but investor behaviour is difficult to predict. The fact is that the issuers of physically backed platinum ETFs have already been selling the precious grey metal since mid-2021, as investment interest has fallen. In this way, almost 1 million troy ounces or about 30 tonnes of additional platinum have come onto the market since then. However, the WPIC’s observation about the recent increase in industrial demand, which absorbed the previous oversupply, is correct. For example, the production of passenger cars with conventional petrol and diesel engines increased as the previously tense international supply chains returned to normal. Important components such as chips, which could not be shipped due to covid restrictions, are finding their way back into factories.

In addition, platinum’s price advantage over the more expensive palladium is gradually causing the automotive industry to shift its production of exhaust catalytic converters. In the long run, the prices of the two metals should converge. Initially, however, the impending recession could depress demand from the automotive sector and the rest of the industries. It would, therefore, not be surprising if platinum becomes somewhat cheaper again in the coming months.

Written by the market specialist Dr. Thorsten Proettel on behalf of C.Hafner.

About the Author:

Dr. Thorsten Proettel has worked in economic, commodity and capital market analysis for more than 20 years. During this time, the trained banker was responsible for the precious metals forecasts of Landesbank Baden-Württemberg from 2007 to 2017. Not least due to his studies and doctorate with a focus on monetary policy and economic history, he is also very familiar with the significance of gold & co. as a currency metal.

Disclaimer:

C.HAFNER GmbH & Co. KG, Wimsheim. The opinions and market information published in the report are based on assessments by C. HAFNER GmbH & Co. KG at the time of writing. The information and assessments do not constitute any form of advice or recommendation, forecasts and expectations are subject to the usual market risks and the actual results may differ considerably from the assumptions and expectations. C. HAFNER GmbH & Co. KG/NSG Sweden AB is under no obligation to inform readers if any assumption, estimate or forecast changes or is no longer accurate. Neither C. HAFNER GmbH & Co. KG nor its management bodies and employees accept liability for any damage or loss arising from the use of this information. This text is exclusively for the information of the recipient. No part of this document may be reproduced in any form or by any means without the written permission of C. HAFNER GmbH & Co. KG is permitted. Responsible according to § 55 Abs.2 RStV: Dr. Philipp Reisert

Published December 21, 2022