Palladiumprisets utveckling – C.Hafners rapport för Q4

Palladium price falls despite sanctioning

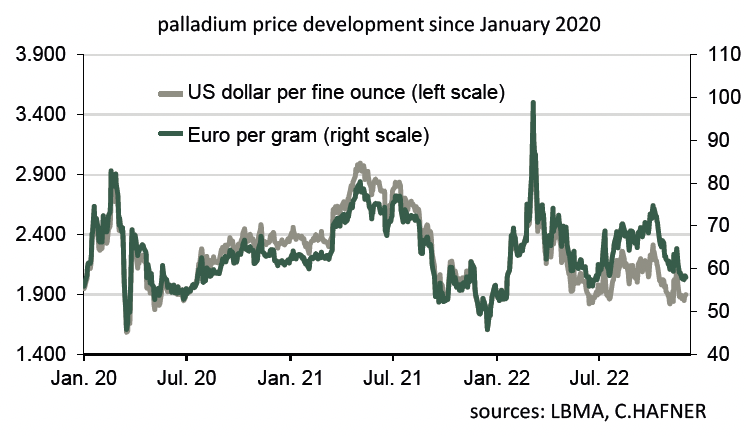

In April, the London platinum and palladium exchange LPPM revoked the so-called Good Delivery status of Russian refiners in the wake of the attack on Ukraine. But despite Russia being the main source of platinum, the price has been falling recently.

Since the publication of our last report at the beginning of September, the palladium price fell from around US$2,000 (€65 per gram) to US$1,900 per troy ounce (€58 per gram). Despite the exclusion of the Russian palladium refineries, there was little sign of bottlenecks on the market in London. Presumably, like Russian oil, the metal will find its way to buyers through alternative channels. It is interesting that the prediction of a massive market deficit for the palladium market, in contrast to the platinum market, did not trigger a price surge.

Just a week after the World Platinum Investment Council, the world’s top palladium miner, Russia’s Norils Nickel, released a similar assessment in late November. According to this, there is already a supply gap of 800,000 troy ounces in 2022, which corresponds to just under 25 tonnes with a total annual supply of only 300 tonnes. The Russians expect demand to fall by 4% in 2022, partly because the automotive industry is replacing expensive palladium with cheaper palladium to produce catalytic converters. But supply has also fallen faster due to strikes and power cuts in the second most important mining country, South Africa. This assessment from Russia, however, does not match the price decline in recent weeks, and the justification for a continuation of the alleged shortages next year may not be convincing either. According to this, a 10% increase in demand is to be expected in 2023, as the further easing of international supply chains would lead to higher car production. In view of the impending recession in many countries, there is more of a risk of a decline in demand, and, in the long term, the trend towards electromobility is also likely to depress demand in the automotive industry. However, should the price really soften in the coming year due to a difficult economic situation, this would be a good opportunity for regular palladium buyers to supplement their stocks. In view of the high importance of Russia for supply and the ever-tougher sanctions imposed by the West, future real supply bottlenecks cannot be ruled out.

Written by the market specialist Dr. Thorsten Proettel on behalf of C.Hafner.

About the Author:

Dr. Thorsten Proettel has worked in economic, commodity and capital market analysis for more than 20 years. During this time, the trained banker was responsible for the precious metals forecasts of Landesbank Baden-Württemberg from 2007 to 2017. Not least due to his studies and doctorate with a focus on monetary policy and economic history, he is also very familiar with the significance of gold & co. as a currency metal.

Disclaimer:

C.HAFNER GmbH & Co. KG, Wimsheim. The opinions and market information published in the report are based on assessments by C. HAFNER GmbH & Co. KG at the time of writing. The information and assessments do not constitute any form of advice or recommendation, forecasts and expectations are subject to the usual market risks and the actual results may differ considerably from the assumptions and expectations. C. HAFNER GmbH & Co. KG/NSG Sweden AB is under no obligation to inform readers if any assumption, estimate or forecast changes or is no longer accurate. Neither C. HAFNER GmbH & Co. KG nor its management bodies and employees accept liability for any damage or loss arising from the use of this information. This text is exclusively for the information of the recipient. No part of this document may be reproduced in any form or by any means without the written permission of C. HAFNER GmbH & Co. KG is permitted. Responsible according to § 55 Abs.2 RStV: Dr. Philipp Reisert

Publicerad 22 december, 2022