Silverprisets utveckling – C.Hafners rapport för Q4

A volatile year ahead for the silver price

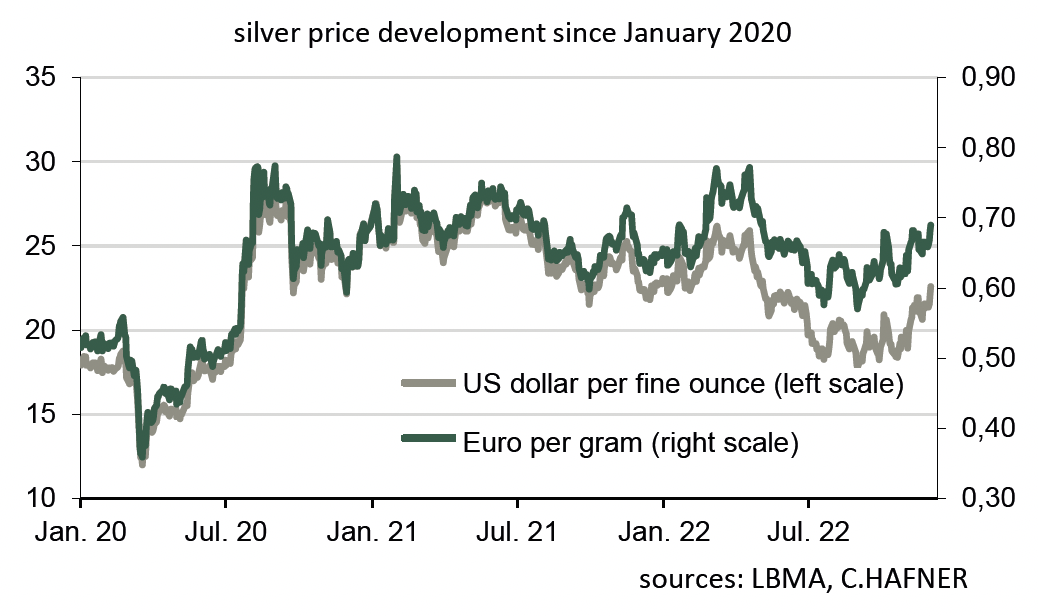

The price of silver has risen in recent weeks in view of the US Federal Reserve’s expected less extensive interest rate hikes. However, the economic slowdown is likely to dampen demand from industry.

The price of silver has developed in a similar way to the price of gold in recent weeks, but with the difference that the price started to rise again at the end of October. In addition, the price of silver in US dollars has risen strongly by 24% since the beginning of September and in euros by around 17% to just under €0.70 cents per gram.

Typically, silver is somewhat more volatile than gold. Therefore, the opposing effects described above of fewer future key rate hikes in the US and the possible start of a recession in the coming months could cause some turbulence. If the economies in Europe and the USA do indeed enter a crisis in 2023, then “safe havens” such as gold are likely to be in demand. The demand for silver for investment purposes should also benefit from this. Those who cannot afford gold will buy silver. However, industrial demand to produce everything from electronic components to solar cells usually has a greater weight in pricing.

In the last brief recession due to the Corona pandemic in the spring of 2020, the price of silver plummeted by 35% in a matter of weeks, and in the wake of the Lehman bankruptcy in 2008, silver fell by about 26% before recovering relatively quickly. Now, there is nothing to suggest a repeat of such extreme events in 2023, but even a normal economic slowdown is likely to leave its mark on the industry, compounded by the pronounced crisis in the real estate industry in China. Property purchases in the People’s Republic have been falling for more than a year, most recently by 23% compared to the same month last year. At the same time, the Chinese economy is the biggest unknown factor in silver price development. The government in Beijing has an interest in ensuring that the economic development does not get out of hand. Therefore, at a certain point, government support measures are a realistic option, and a further easing of the still very strict ‘Zero Covid’ policy would also have a stimulating effect. In this case, the Chinese industry’s hunger for raw materials would increase again, which could boost the silver price even if Europe and the USA are in recession.

Written by the market specialist Dr. Thorsten Proettel on behalf of C.Hafner.

About the Author:

Dr. Thorsten Proettel has worked in economic, commodity and capital market analysis for more than 20 years. During this time, the trained banker was responsible for the precious metals forecasts of Landesbank Baden-Württemberg from 2007 to 2017. Not least due to his studies and doctorate with a focus on monetary policy and economic history, he is also very familiar with the significance of gold & co. as a currency metal.

Disclaimer:

C.HAFNER GmbH & Co. KG, Wimsheim. The opinions and market information published in the report are based on assessments by C. HAFNER GmbH & Co. KG at the time of writing. The information and assessments do not constitute any form of advice or recommendation, forecasts and expectations are subject to the usual market risks and the actual results may differ considerably from the assumptions and expectations. C. HAFNER GmbH & Co. KG/NSG Sweden AB is under no obligation to inform readers if any assumption, estimate or forecast changes or is no longer accurate. Neither C. HAFNER GmbH & Co. KG nor its management bodies and employees accept liability for any damage or loss arising from the use of this information. This text is exclusively for the information of the recipient. No part of this document may be reproduced in any form or by any means without the written permission of C. HAFNER GmbH & Co. KG is permitted. Responsible according to § 55 Abs.2 RStV: Dr. Philipp Reisert

Publicerad 20 december, 2022